Form 2441 Care Provider The Yes Cbx

Form 2441 Care Provider The Yes Cbx - However, if you pay someone to come to your home and care for your dependent or spouse and you can control not only what work. You must check either the yes or no box in column (d) to indicate whether or not the care provider listed in column (a) was your. The irs form 2441 instructions, under purpose of form, reads: Someone who works in your home to provide care, such as a nanny or babysitter who works in your home, which makes them your. You can’t claim a credit for child and dependent care expenses if your filing. Go to www.irs.gov/form2441 for instructions and the latest information. “if you paid someone to care for your child or other qualifying person so.

Someone who works in your home to provide care, such as a nanny or babysitter who works in your home, which makes them your. The irs form 2441 instructions, under purpose of form, reads: Go to www.irs.gov/form2441 for instructions and the latest information. “if you paid someone to care for your child or other qualifying person so. You can’t claim a credit for child and dependent care expenses if your filing. You must check either the yes or no box in column (d) to indicate whether or not the care provider listed in column (a) was your. However, if you pay someone to come to your home and care for your dependent or spouse and you can control not only what work.

“if you paid someone to care for your child or other qualifying person so. Someone who works in your home to provide care, such as a nanny or babysitter who works in your home, which makes them your. The irs form 2441 instructions, under purpose of form, reads: You can’t claim a credit for child and dependent care expenses if your filing. Go to www.irs.gov/form2441 for instructions and the latest information. You must check either the yes or no box in column (d) to indicate whether or not the care provider listed in column (a) was your. However, if you pay someone to come to your home and care for your dependent or spouse and you can control not only what work.

Form 2441 Definition

“if you paid someone to care for your child or other qualifying person so. Go to www.irs.gov/form2441 for instructions and the latest information. The irs form 2441 instructions, under purpose of form, reads: However, if you pay someone to come to your home and care for your dependent or spouse and you can control not only what work. You must.

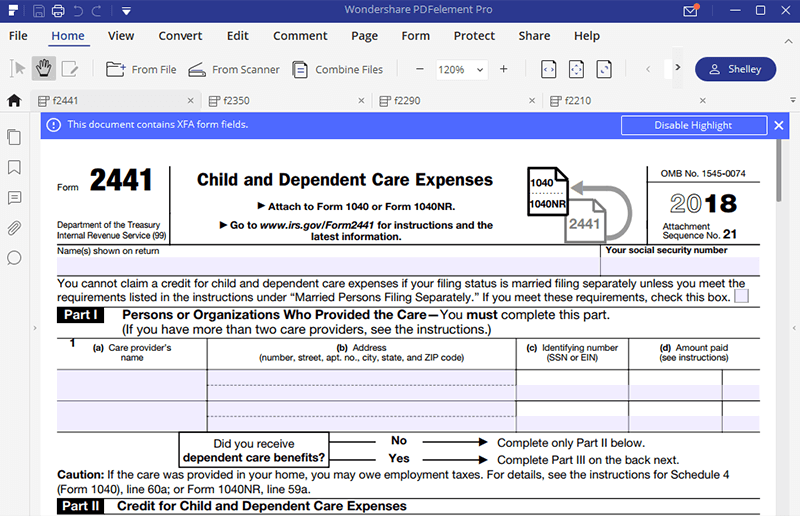

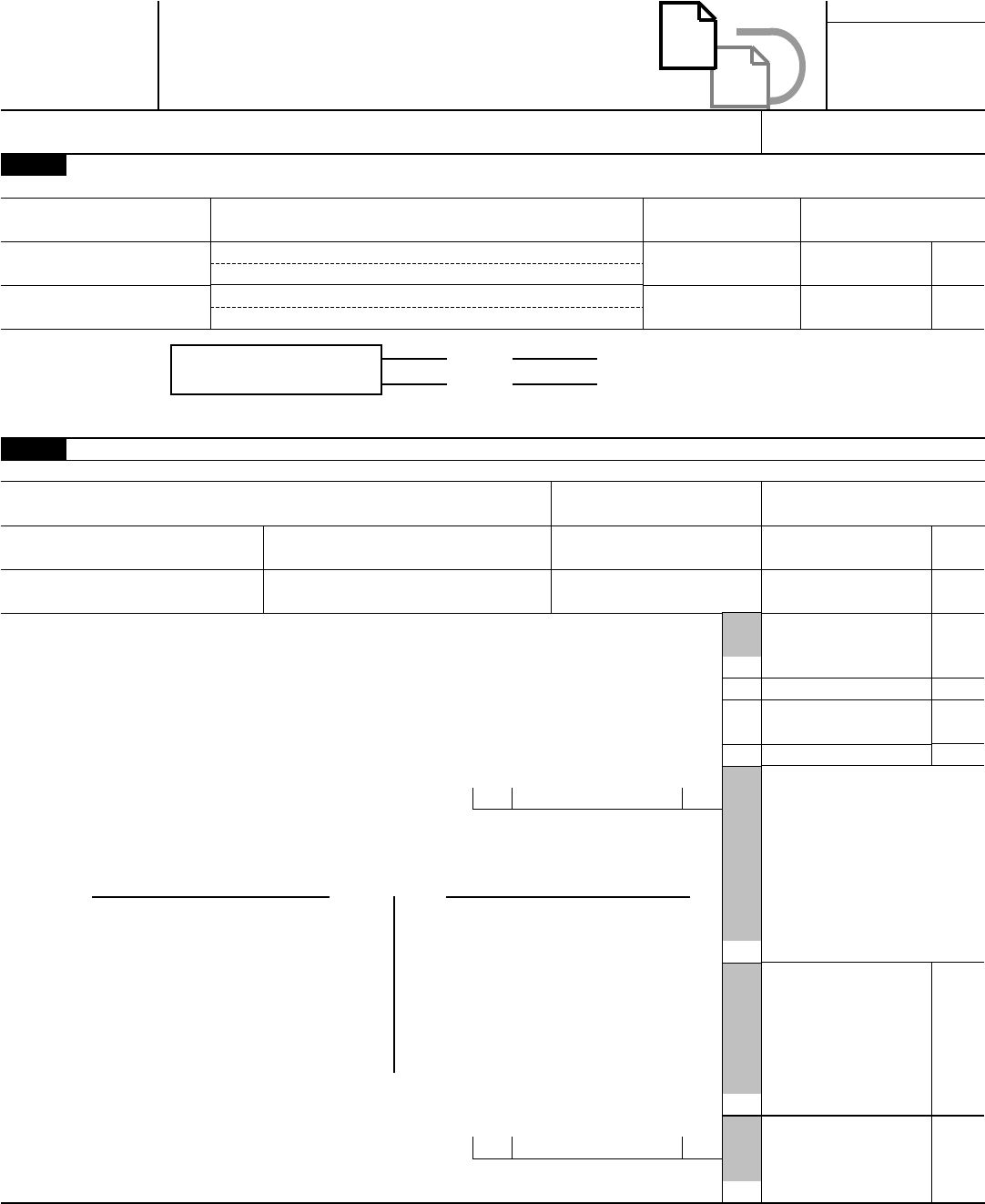

Form 2441 Edit, Fill, Sign Online Handypdf

However, if you pay someone to come to your home and care for your dependent or spouse and you can control not only what work. You must check either the yes or no box in column (d) to indicate whether or not the care provider listed in column (a) was your. “if you paid someone to care for your child.

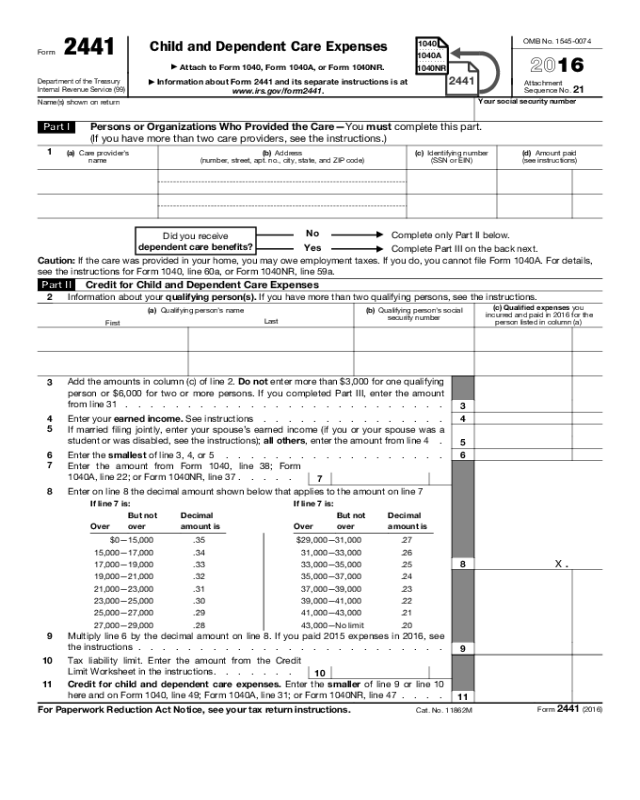

Ssurvivor Form 2441 Instructions 2016

The irs form 2441 instructions, under purpose of form, reads: You can’t claim a credit for child and dependent care expenses if your filing. You must check either the yes or no box in column (d) to indicate whether or not the care provider listed in column (a) was your. “if you paid someone to care for your child or.

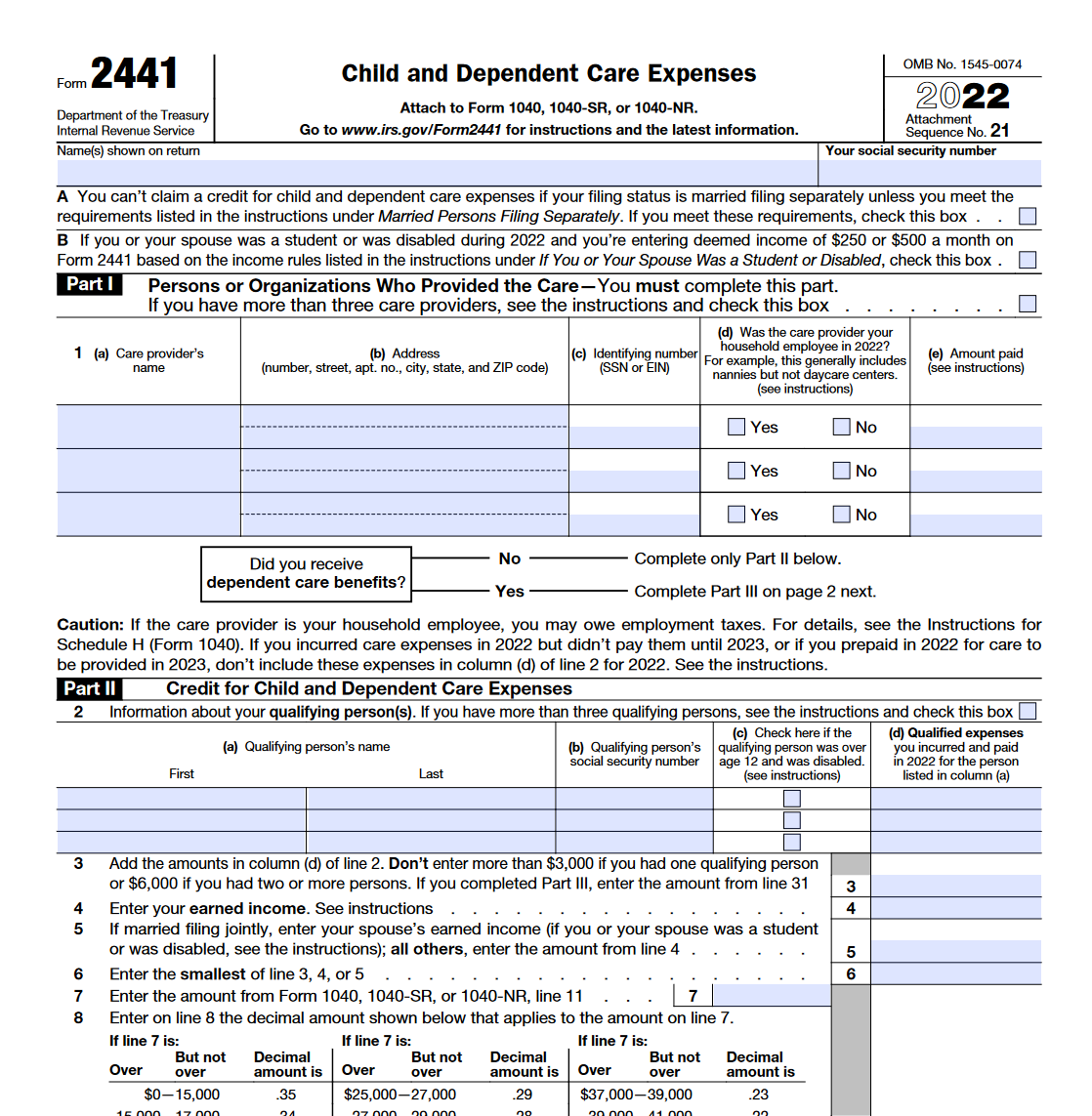

IRS Form 2441. Child and Dependent Care Expenses Forms Docs 2023

“if you paid someone to care for your child or other qualifying person so. The irs form 2441 instructions, under purpose of form, reads: Go to www.irs.gov/form2441 for instructions and the latest information. You must check either the yes or no box in column (d) to indicate whether or not the care provider listed in column (a) was your. Someone.

What is IRS Form 2441, and How Do I Claim it? Civic Tax Relief

You must check either the yes or no box in column (d) to indicate whether or not the care provider listed in column (a) was your. Go to www.irs.gov/form2441 for instructions and the latest information. Someone who works in your home to provide care, such as a nanny or babysitter who works in your home, which makes them your. You.

Instructions for How to Fill in IRS Form 2441

However, if you pay someone to come to your home and care for your dependent or spouse and you can control not only what work. The irs form 2441 instructions, under purpose of form, reads: You must check either the yes or no box in column (d) to indicate whether or not the care provider listed in column (a) was.

Filing Tax Form 2441 Child and Dependent Care Expenses Reconcile Books

The irs form 2441 instructions, under purpose of form, reads: Someone who works in your home to provide care, such as a nanny or babysitter who works in your home, which makes them your. However, if you pay someone to come to your home and care for your dependent or spouse and you can control not only what work. Go.

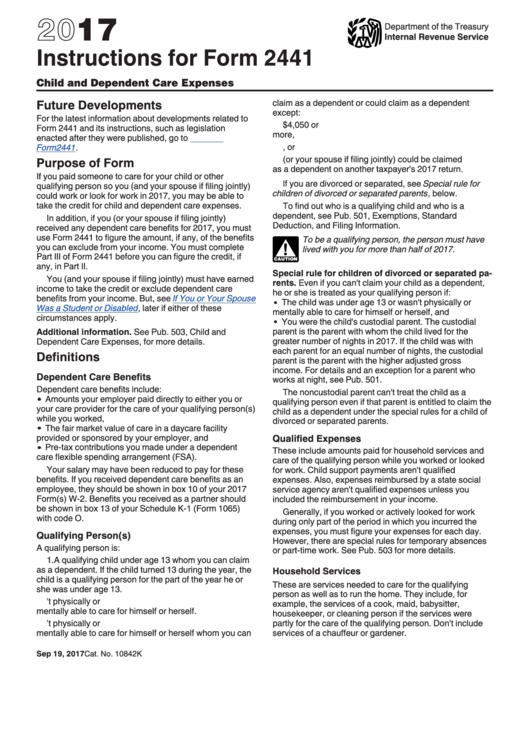

Instructions For Form 2441 Child And Dependent Care Expenses 2017

Someone who works in your home to provide care, such as a nanny or babysitter who works in your home, which makes them your. You can’t claim a credit for child and dependent care expenses if your filing. The irs form 2441 instructions, under purpose of form, reads: However, if you pay someone to come to your home and care.

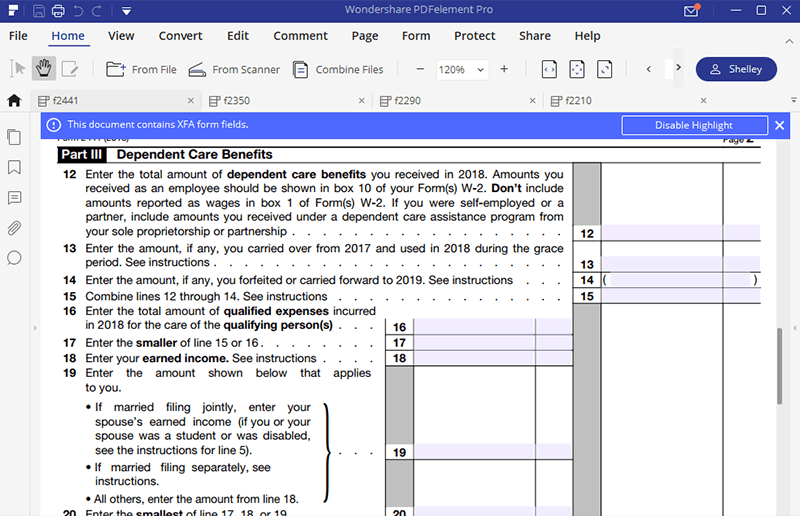

Ssurvivor Form 2441 Instructions 2019

You can’t claim a credit for child and dependent care expenses if your filing. Go to www.irs.gov/form2441 for instructions and the latest information. “if you paid someone to care for your child or other qualifying person so. The irs form 2441 instructions, under purpose of form, reads: Someone who works in your home to provide care, such as a nanny.

Form 2441 Edit, Fill, Sign Online Handypdf

Someone who works in your home to provide care, such as a nanny or babysitter who works in your home, which makes them your. However, if you pay someone to come to your home and care for your dependent or spouse and you can control not only what work. The irs form 2441 instructions, under purpose of form, reads: “if.

You Must Check Either The Yes Or No Box In Column (D) To Indicate Whether Or Not The Care Provider Listed In Column (A) Was Your.

Go to www.irs.gov/form2441 for instructions and the latest information. The irs form 2441 instructions, under purpose of form, reads: Someone who works in your home to provide care, such as a nanny or babysitter who works in your home, which makes them your. You can’t claim a credit for child and dependent care expenses if your filing.

However, If You Pay Someone To Come To Your Home And Care For Your Dependent Or Spouse And You Can Control Not Only What Work.

“if you paid someone to care for your child or other qualifying person so.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)