Esbt Election Form

Esbt Election Form - An electing small business trust (esbt) within the meaning of section 1361(e) is treated as two separate trusts for purposes of chapter 1 of the. This revenue procedure provides a simplified method for taxpayers to request relief for late s corporation elections, electing small business. Specific to relief for late esbt and qsst elections, the revenue procedure requires an election form signed by the appropriate party. To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which.

Specific to relief for late esbt and qsst elections, the revenue procedure requires an election form signed by the appropriate party. To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which. This revenue procedure provides a simplified method for taxpayers to request relief for late s corporation elections, electing small business. An electing small business trust (esbt) within the meaning of section 1361(e) is treated as two separate trusts for purposes of chapter 1 of the.

To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which. Specific to relief for late esbt and qsst elections, the revenue procedure requires an election form signed by the appropriate party. This revenue procedure provides a simplified method for taxpayers to request relief for late s corporation elections, electing small business. An electing small business trust (esbt) within the meaning of section 1361(e) is treated as two separate trusts for purposes of chapter 1 of the.

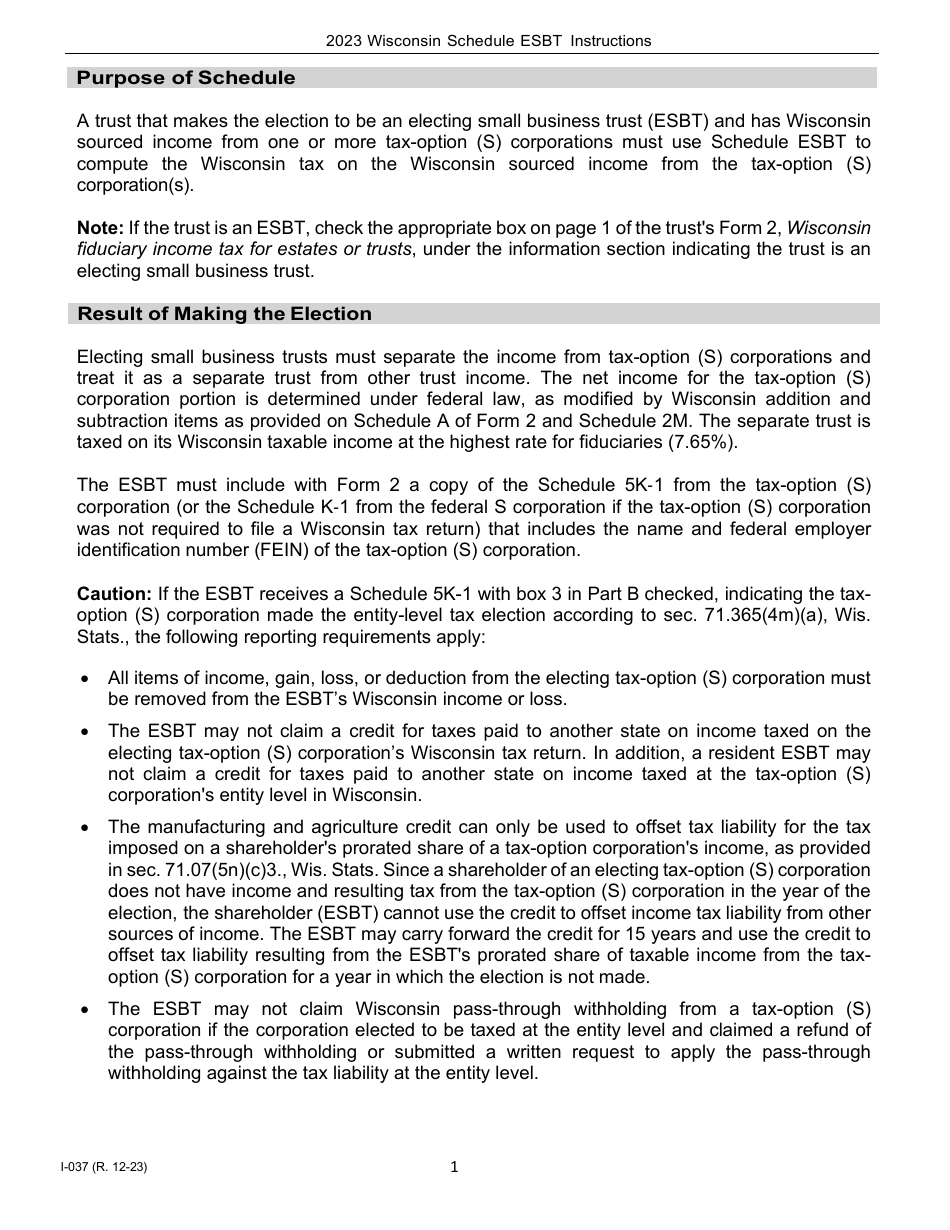

Download Instructions for Form I237 Schedule ESBT Computation of

Specific to relief for late esbt and qsst elections, the revenue procedure requires an election form signed by the appropriate party. An electing small business trust (esbt) within the meaning of section 1361(e) is treated as two separate trusts for purposes of chapter 1 of the. To obtain relief, the trustee of an esbt or the current income beneficiary of.

Election Day 1 Coloring Play Free Coloring Game Online

An electing small business trust (esbt) within the meaning of section 1361(e) is treated as two separate trusts for purposes of chapter 1 of the. Specific to relief for late esbt and qsst elections, the revenue procedure requires an election form signed by the appropriate party. This revenue procedure provides a simplified method for taxpayers to request relief for late.

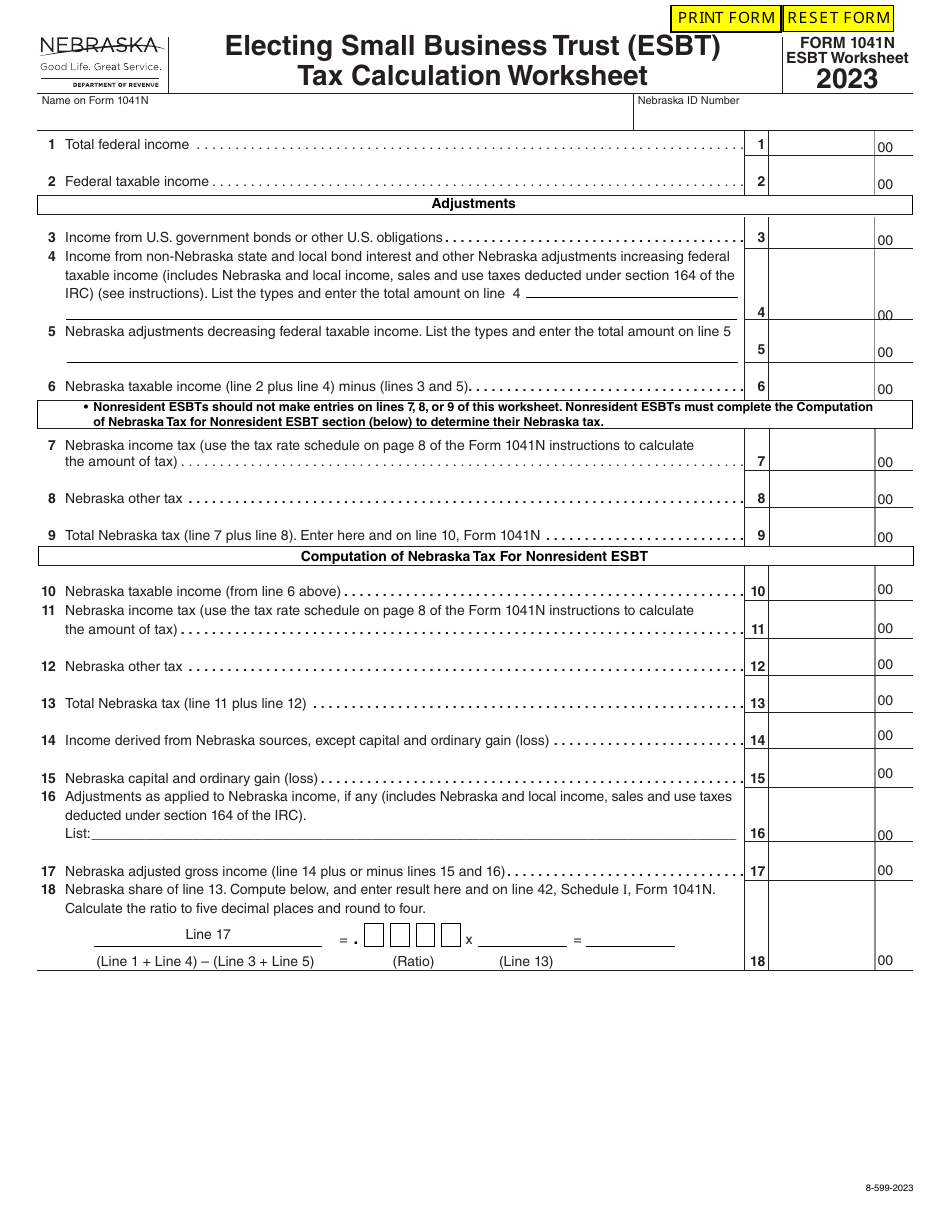

Form 1041N Worksheet ESBT 2023 Fill Out, Sign Online and Download

To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which. Specific to relief for late esbt and qsst elections, the revenue procedure requires an election form signed by the appropriate party. This revenue procedure provides a simplified method for taxpayers to request relief for late.

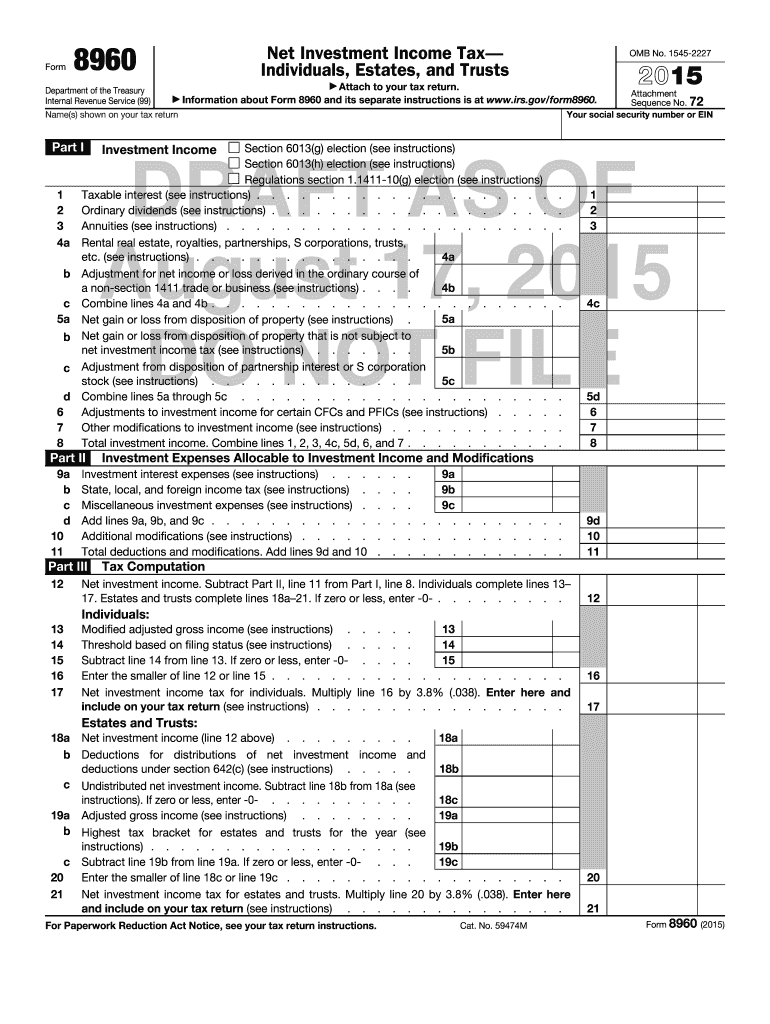

10g Election Complete with ease airSlate SignNow

Specific to relief for late esbt and qsst elections, the revenue procedure requires an election form signed by the appropriate party. This revenue procedure provides a simplified method for taxpayers to request relief for late s corporation elections, electing small business. An electing small business trust (esbt) within the meaning of section 1361(e) is treated as two separate trusts for.

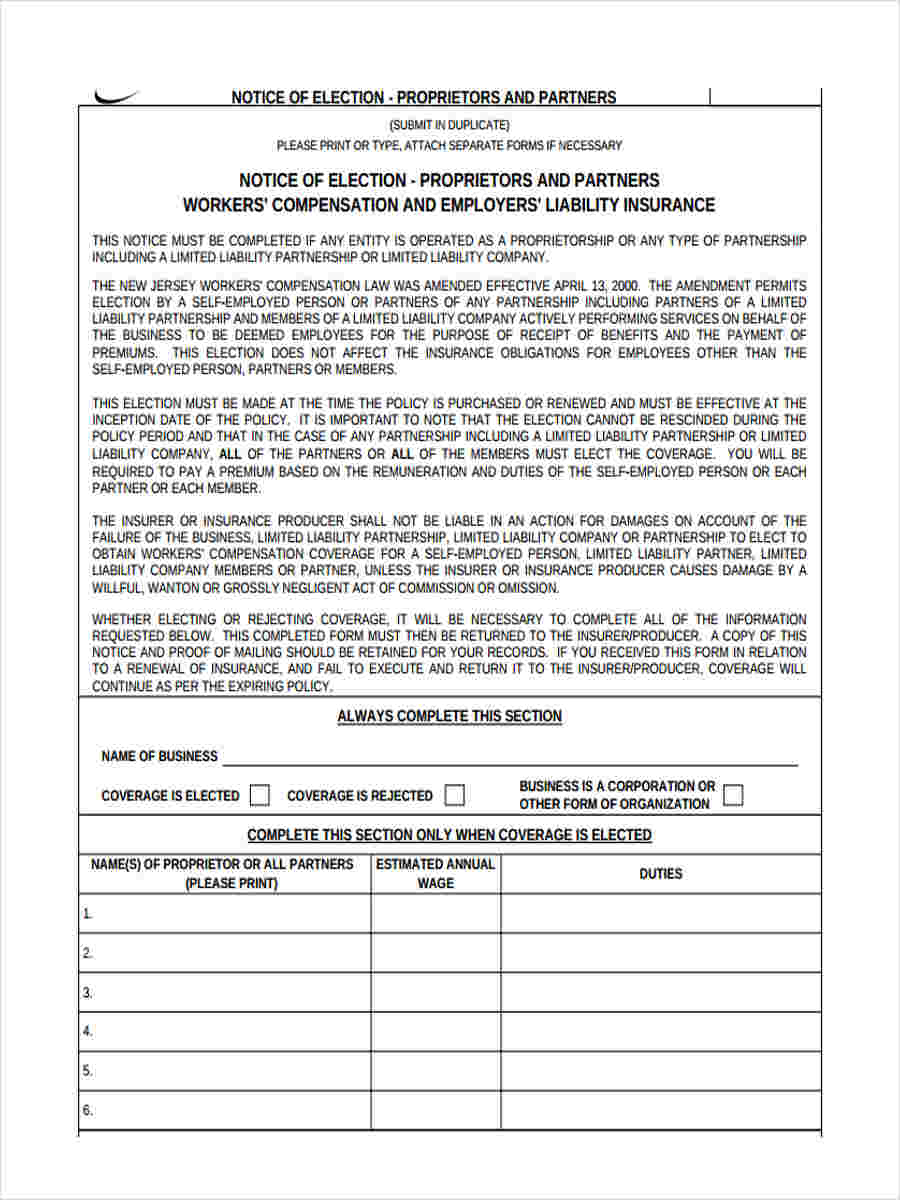

FREE 6+ Sample Notice of Election Forms in MS Word PDF Excel

This revenue procedure provides a simplified method for taxpayers to request relief for late s corporation elections, electing small business. Specific to relief for late esbt and qsst elections, the revenue procedure requires an election form signed by the appropriate party. An electing small business trust (esbt) within the meaning of section 1361(e) is treated as two separate trusts for.

Election Form PDF

To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which. Specific to relief for late esbt and qsst elections, the revenue procedure requires an election form signed by the appropriate party. This revenue procedure provides a simplified method for taxpayers to request relief for late.

Sample qsst election form Fill out & sign online DocHub

To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which. Specific to relief for late esbt and qsst elections, the revenue procedure requires an election form signed by the appropriate party. An electing small business trust (esbt) within the meaning of section 1361(e) is treated.

Ssurvivor Form 2553 Irs Pdf

To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which. An electing small business trust (esbt) within the meaning of section 1361(e) is treated as two separate trusts for purposes of chapter 1 of the. Specific to relief for late esbt and qsst elections, the.

IRS Form 2553 Late Filing Procedures Under Rev Proc 201330 YouTube

To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which. Specific to relief for late esbt and qsst elections, the revenue procedure requires an election form signed by the appropriate party. An electing small business trust (esbt) within the meaning of section 1361(e) is treated.

Sc Republican Primary 2024 Ballot Meara Marcela

To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which. Specific to relief for late esbt and qsst elections, the revenue procedure requires an election form signed by the appropriate party. This revenue procedure provides a simplified method for taxpayers to request relief for late.

This Revenue Procedure Provides A Simplified Method For Taxpayers To Request Relief For Late S Corporation Elections, Electing Small Business.

Specific to relief for late esbt and qsst elections, the revenue procedure requires an election form signed by the appropriate party. To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which. An electing small business trust (esbt) within the meaning of section 1361(e) is treated as two separate trusts for purposes of chapter 1 of the.