Eftps You Are Not Enrolled For This Tax Form

Eftps You Are Not Enrolled For This Tax Form - All federal taxes for both businesses and individuals can be paid using eftps. You can make your payments at the following link:. You must be enrolled to use the eftps® tax payment service. Missing your enrollment number or pin? Contact eftps customer service:1.800.555.4477 for all inquiries. Payments must be scheduled by 8 p.m. The information will be used to enroll you in the electronic federal tax. All federal taxes for both businesses and individuals can be paid using eftps. To enroll, click on enrollment at the top of this page and follow the steps. To participate in eftps, you must enroll by calling eftps customer service to get an enrollment form and instructions.

All federal taxes for both businesses and individuals can be paid using eftps. Creating a password is necessary. Payments must be scheduled by 8 p.m. All federal taxes for both businesses and individuals can be paid using eftps. Section 6109 requires filers to provide their ssn or other identifying numbers. The information will be used to enroll you in the electronic federal tax. Missing your enrollment number or pin? You can make your payments at the following link:. To participate in eftps, you must enroll by calling eftps customer service to get an enrollment form and instructions. You must be enrolled to use the eftps® tax payment service.

Section 6109 requires filers to provide their ssn or other identifying numbers. All federal taxes for both businesses and individuals can be paid using eftps. Contact eftps customer service:1.800.555.4477 for all inquiries. Missing your enrollment number or pin? Payments must be scheduled by 8 p.m. Creating a password is necessary. The information will be used to enroll you in the electronic federal tax. You did not have to enroll in eftps to make estimated quarterly tax payments. You can make your payments at the following link:. All federal taxes for both businesses and individuals can be paid using eftps.

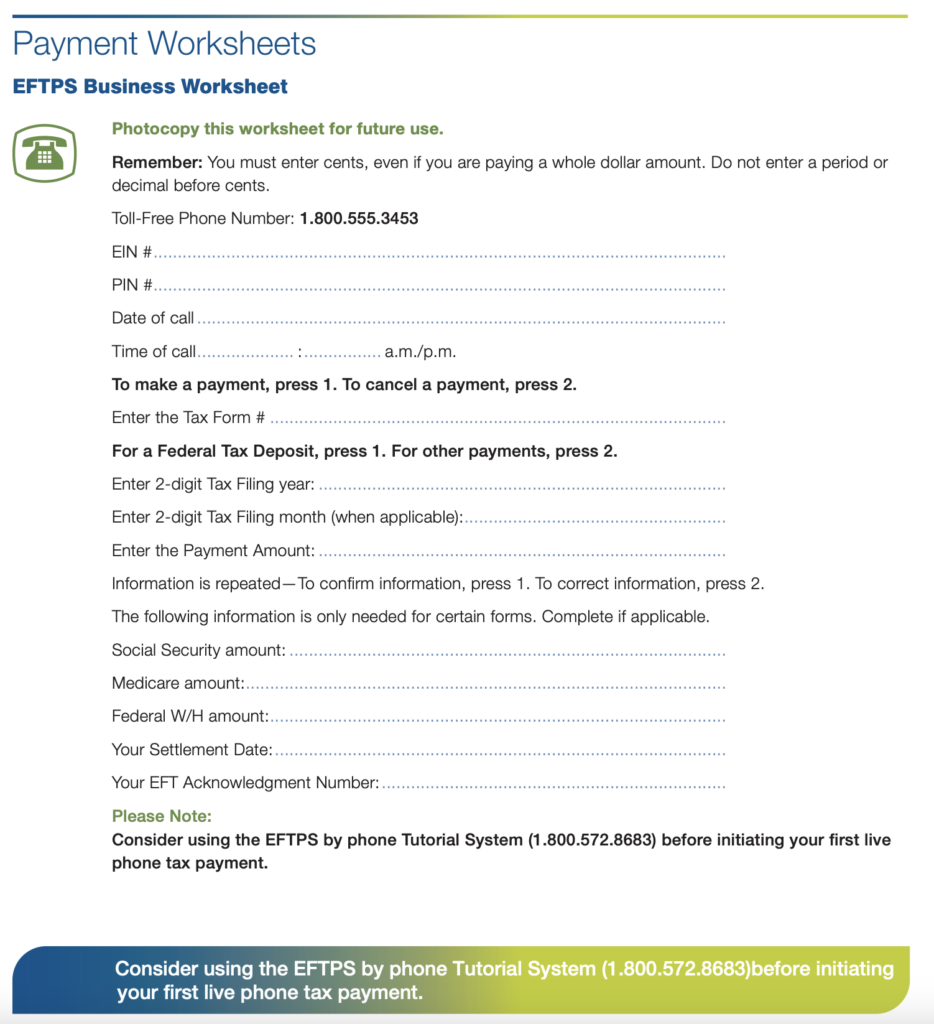

Tax Payment Report Worksheet Eftps Voice Response System Short Form

All federal taxes for both businesses and individuals can be paid using eftps. To enroll, click on enrollment at the top of this page and follow the steps. You must be enrolled to use the eftps® tax payment service. Section 6109 requires filers to provide their ssn or other identifying numbers. Missing your enrollment number or pin?

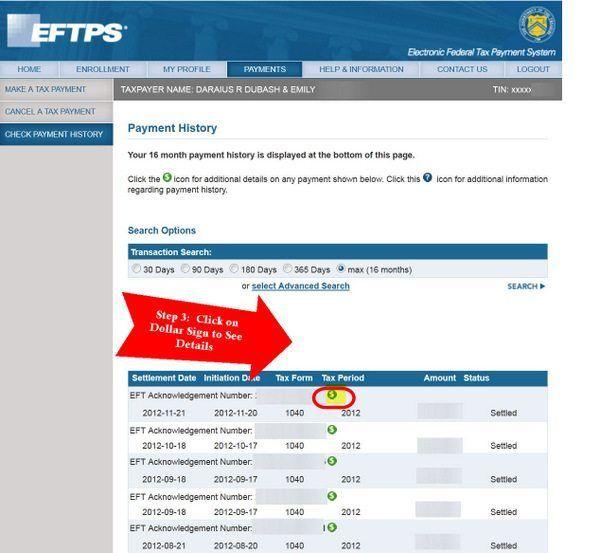

EFTPS Make Tax Payments Online

To enroll, click on enrollment at the top of this page and follow the steps. Section 6109 requires filers to provide their ssn or other identifying numbers. All federal taxes for both businesses and individuals can be paid using eftps. You must be enrolled to use the eftps® tax payment service. Creating a password is necessary.

How Do I Use the Electronic Federal Tax Payment System (EFTPS

You did not have to enroll in eftps to make estimated quarterly tax payments. Contact eftps customer service:1.800.555.4477 for all inquiries. Creating a password is necessary. To participate in eftps, you must enroll by calling eftps customer service to get an enrollment form and instructions. All federal taxes for both businesses and individuals can be paid using eftps.

Worksheets Eftps Tax Payment Report Worksheet Atidentity Free

All federal taxes for both businesses and individuals can be paid using eftps. Contact eftps customer service:1.800.555.4477 for all inquiries. Payments must be scheduled by 8 p.m. Section 6109 requires filers to provide their ssn or other identifying numbers. The information will be used to enroll you in the electronic federal tax.

Eftps Fillable Form Printable Forms Free Online

To participate in eftps, you must enroll by calling eftps customer service to get an enrollment form and instructions. To enroll, click on enrollment at the top of this page and follow the steps. You can make your payments at the following link:. Section 6109 requires filers to provide their ssn or other identifying numbers. All federal taxes for both.

EFTPS Make Tax Payments Online Tax TaxUni

Payments must be scheduled by 8 p.m. Payments must be scheduled by 8 p.m. All federal taxes for both businesses and individuals can be paid using eftps. Creating a password is necessary. You can make your payments at the following link:.

Electronic Federal Tax Payment System (EFTPS) Investor's wiki

Contact eftps customer service:1.800.555.4477 for all inquiries. Creating a password is necessary. Section 6109 requires filers to provide their ssn or other identifying numbers. You must be enrolled to use the eftps® tax payment service. All federal taxes for both businesses and individuals can be paid using eftps.

Fillable Online Eftps tax payment report worksheet short form. Eftps

Creating a password is necessary. The information will be used to enroll you in the electronic federal tax. Payments must be scheduled by 8 p.m. Missing your enrollment number or pin? To enroll, click on enrollment at the top of this page and follow the steps.

Electronic Federal Tax Payment System (EFTPS) Worksheets Library

Payments must be scheduled by 8 p.m. Missing your enrollment number or pin? You must be enrolled to use the eftps® tax payment service. Section 6109 requires filers to provide their ssn or other identifying numbers. You can make your payments at the following link:.

Eftps Logo LogoDix

You did not have to enroll in eftps to make estimated quarterly tax payments. To enroll, click on enrollment at the top of this page and follow the steps. You can make your payments at the following link:. Payments must be scheduled by 8 p.m. All federal taxes for both businesses and individuals can be paid using eftps.

You Did Not Have To Enroll In Eftps To Make Estimated Quarterly Tax Payments.

Missing your enrollment number or pin? To enroll, click on enrollment at the top of this page and follow the steps. All federal taxes for both businesses and individuals can be paid using eftps. Payments must be scheduled by 8 p.m.

You Must Be Enrolled To Use The Eftps® Tax Payment Service.

Contact eftps customer service:1.800.555.4477 for all inquiries. Section 6109 requires filers to provide their ssn or other identifying numbers. The information will be used to enroll you in the electronic federal tax. To participate in eftps, you must enroll by calling eftps customer service to get an enrollment form and instructions.

You Can Make Your Payments At The Following Link:.

All federal taxes for both businesses and individuals can be paid using eftps. Creating a password is necessary. Payments must be scheduled by 8 p.m.