Discharge Of Indebtedness To The Extent Insolvent

Discharge Of Indebtedness To The Extent Insolvent - Normally, a taxpayer is not required to include forgiven. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. You must complete and file. The final hurdle is convincing the irs that you were insolvent at the time your debt was canceled. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your. You were insolvent to the extent that your liabilities exceeded the fair market value (fmv) of your assets immediately before the discharge. The forgiven debt may be excluded as income under the insolvency exclusion.

Normally, a taxpayer is not required to include forgiven. You must complete and file. You were insolvent to the extent that your liabilities exceeded the fair market value (fmv) of your assets immediately before the discharge. The forgiven debt may be excluded as income under the insolvency exclusion. The final hurdle is convincing the irs that you were insolvent at the time your debt was canceled. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your.

The forgiven debt may be excluded as income under the insolvency exclusion. You were insolvent to the extent that your liabilities exceeded the fair market value (fmv) of your assets immediately before the discharge. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your. Normally, a taxpayer is not required to include forgiven. The final hurdle is convincing the irs that you were insolvent at the time your debt was canceled. You must complete and file.

Discharge of Indebtedness John A. Tatoian Law

The final hurdle is convincing the irs that you were insolvent at the time your debt was canceled. You were insolvent to the extent that your liabilities exceeded the fair market value (fmv) of your assets immediately before the discharge. You must complete and file. If you had debt cancelled and are no longer obligated to repay the debt, you.

PPT Cancellation/discharge of Indebtedness PowerPoint Presentation

The forgiven debt may be excluded as income under the insolvency exclusion. You must complete and file. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer.

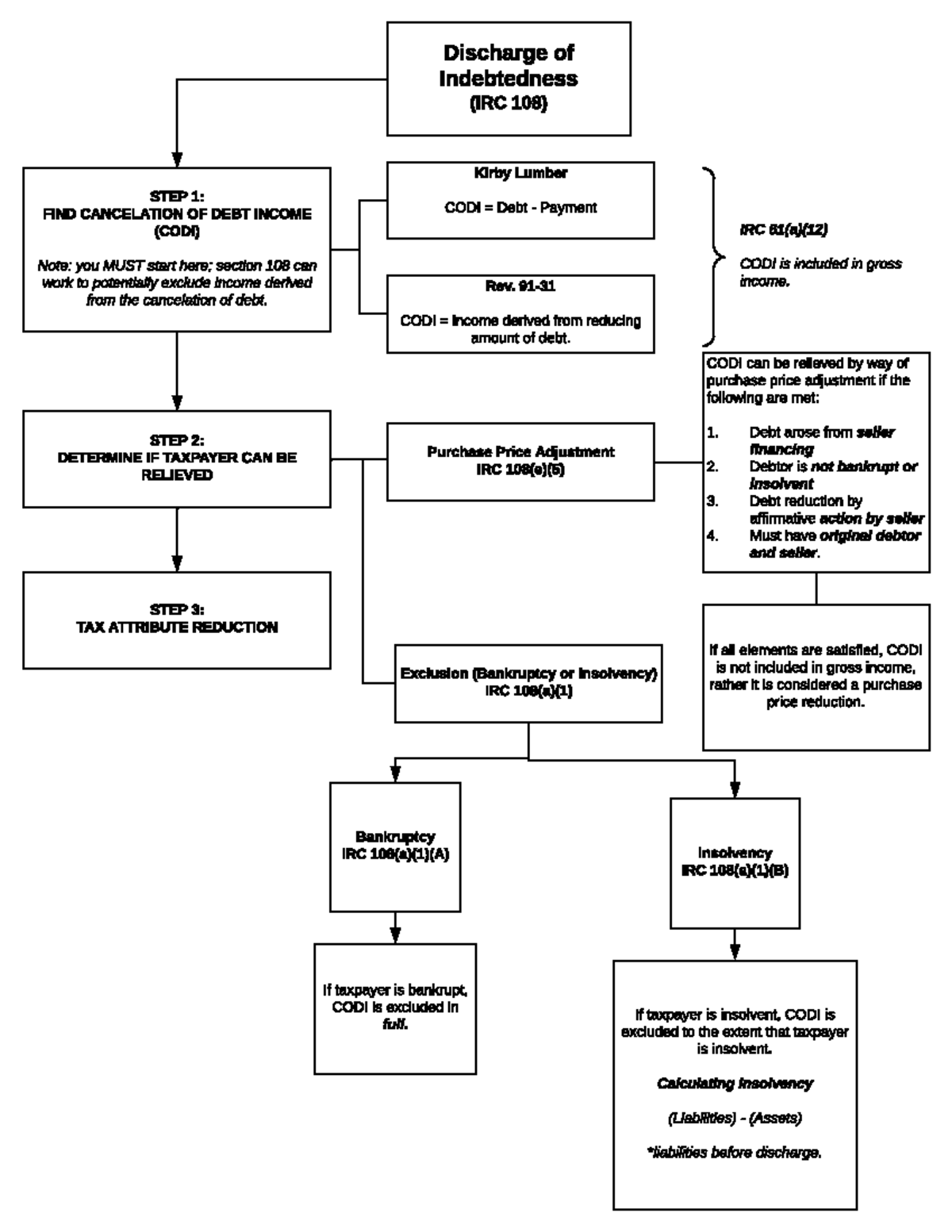

Discharge of Indebtedness Chart 1 Discharge of Indebtedness (IRC

Normally, a taxpayer is not required to include forgiven. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. You must complete and file. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your. The.

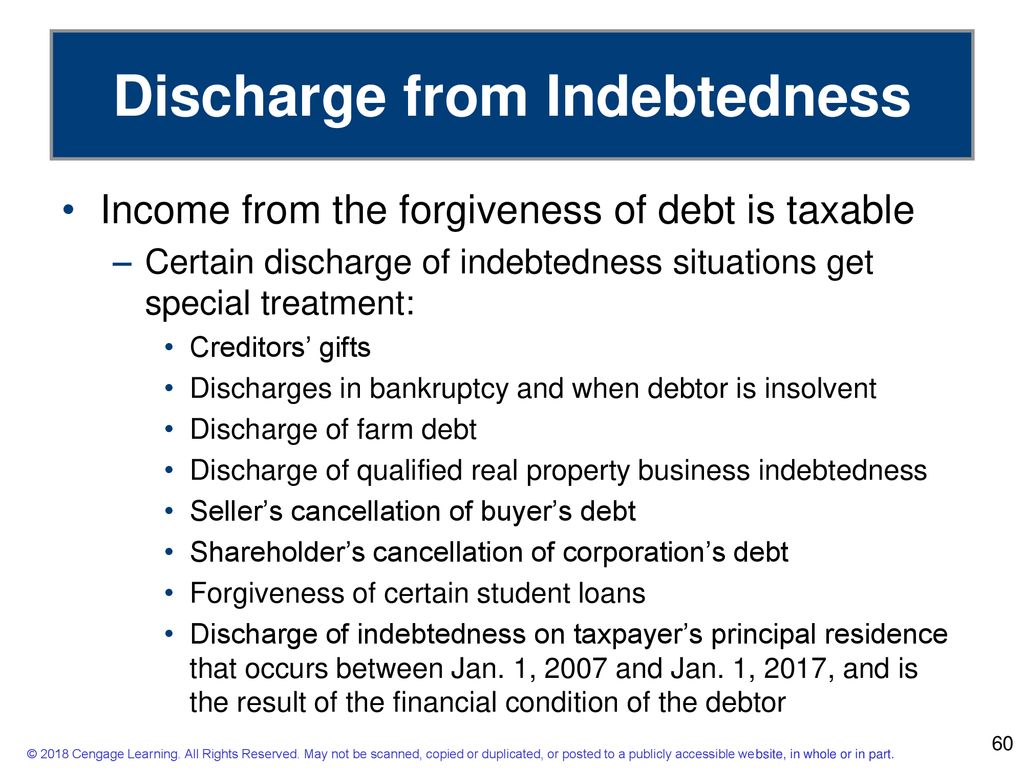

Gross Exclusions ppt download

Normally, a taxpayer is not required to include forgiven. The final hurdle is convincing the irs that you were insolvent at the time your debt was canceled. You must complete and file. The forgiven debt may be excluded as income under the insolvency exclusion. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent.

Discharge of Indebtedness on Principal Residences and Business Real

If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your. You were insolvent to the extent that your liabilities exceeded the fair market value (fmv) of your assets immediately before the discharge. The forgiven debt may be excluded as income under the insolvency exclusion. You.

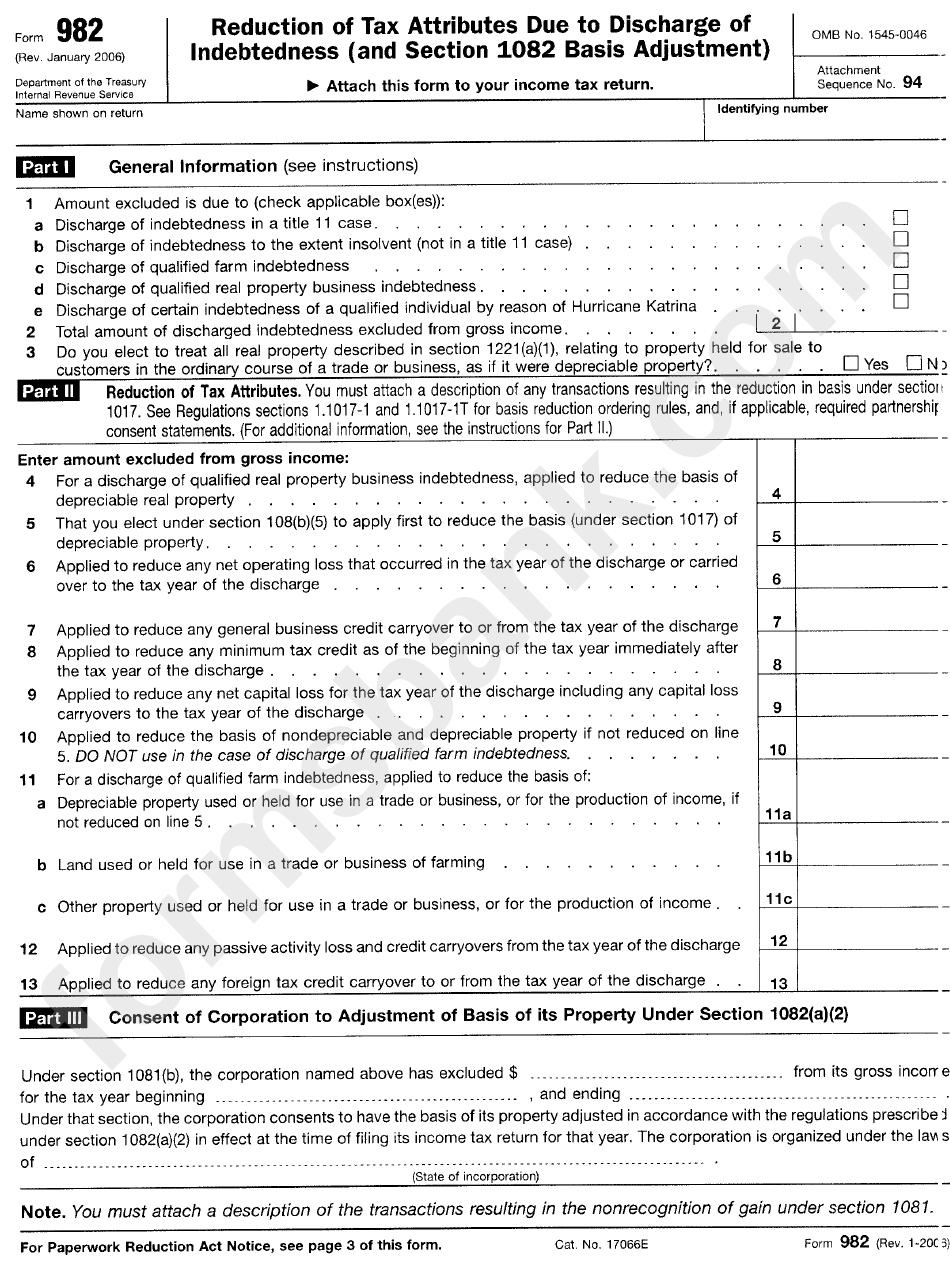

Irs Form 982 Insolvency Worksheet

Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. The final hurdle is convincing the irs that you were insolvent at the time your debt was canceled. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled.

IRS Form 982 Instructions Discharge of Indebtedness

The final hurdle is convincing the irs that you were insolvent at the time your debt was canceled. Normally, a taxpayer is not required to include forgiven. The forgiven debt may be excluded as income under the insolvency exclusion. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. You.

IRS Form 982 Instructions Discharge of Indebtedness

You must complete and file. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your. The final hurdle is convincing the irs that you were insolvent at the time your debt was canceled. Normally, a taxpayer is not required to include forgiven. The forgiven debt.

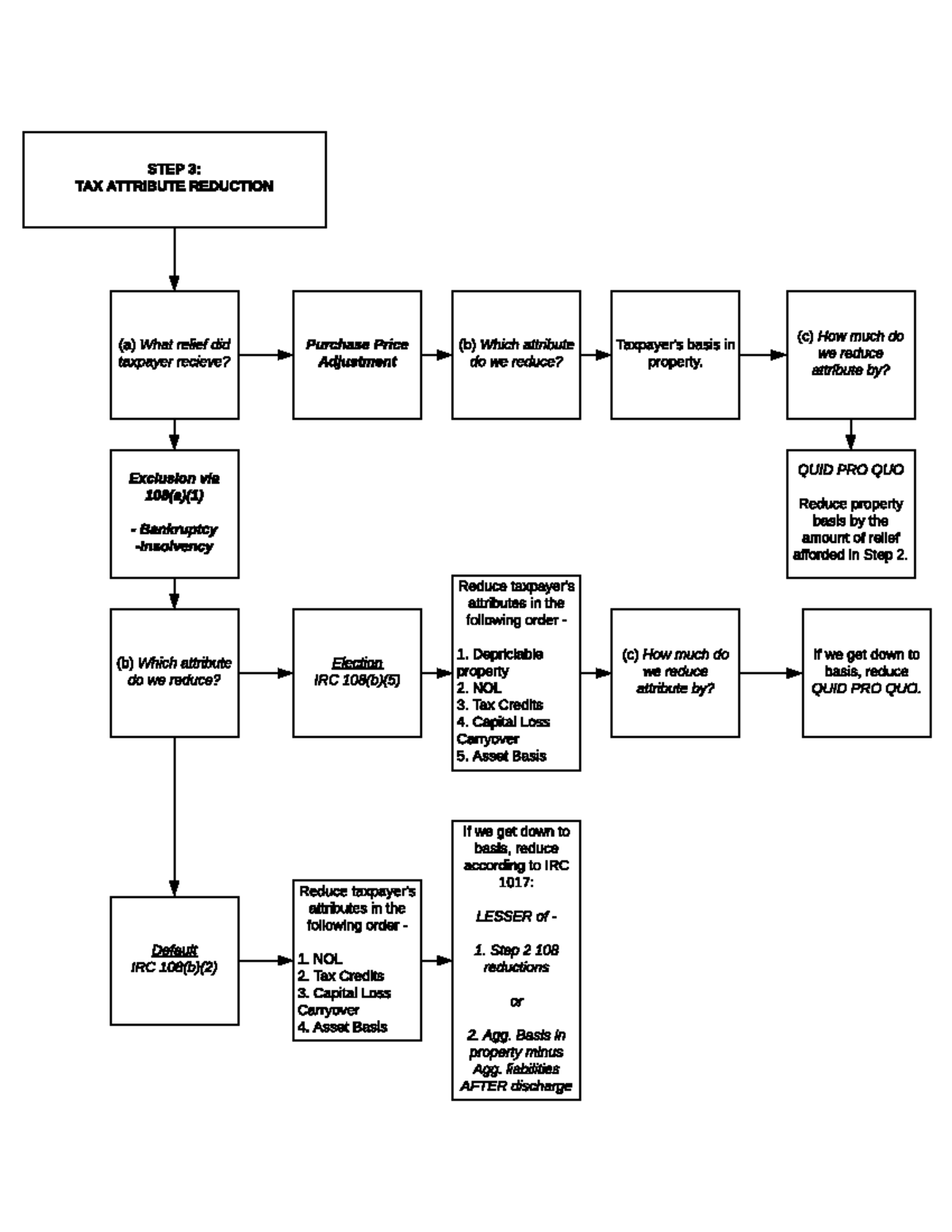

Discharge of Indebtedness Chart 2 STEP 3 TAX ATTRIBUTE REDUCTION

The forgiven debt may be excluded as income under the insolvency exclusion. You must complete and file. You were insolvent to the extent that your liabilities exceeded the fair market value (fmv) of your assets immediately before the discharge. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. Normally,.

PPT Dr H Srinivas , IRPS PowerPoint Presentation, free download ID

You were insolvent to the extent that your liabilities exceeded the fair market value (fmv) of your assets immediately before the discharge. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your. Normally, a taxpayer is not required to include forgiven. You must complete and.

You Were Insolvent To The Extent That Your Liabilities Exceeded The Fair Market Value (Fmv) Of Your Assets Immediately Before The Discharge.

The final hurdle is convincing the irs that you were insolvent at the time your debt was canceled. The forgiven debt may be excluded as income under the insolvency exclusion. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your. Normally, a taxpayer is not required to include forgiven.

You Must Complete And File.

Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent.