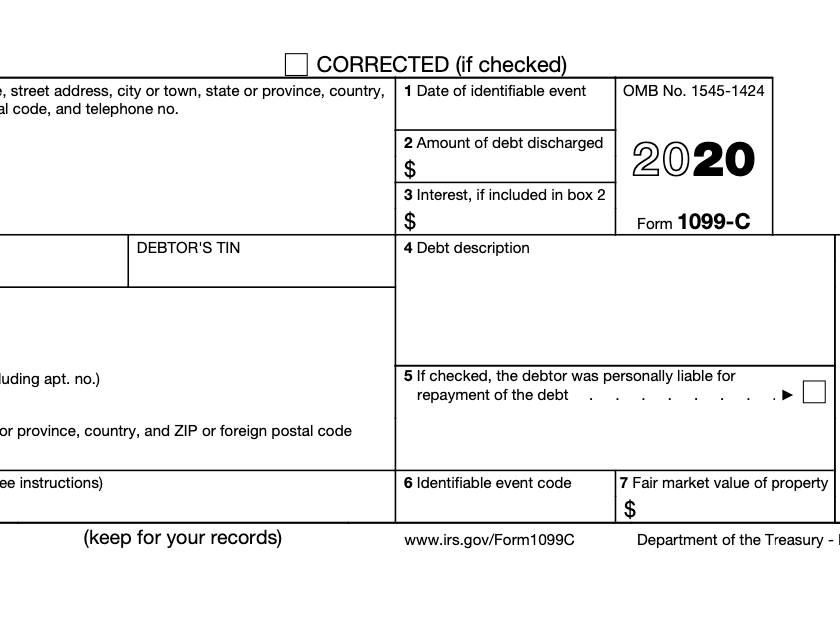

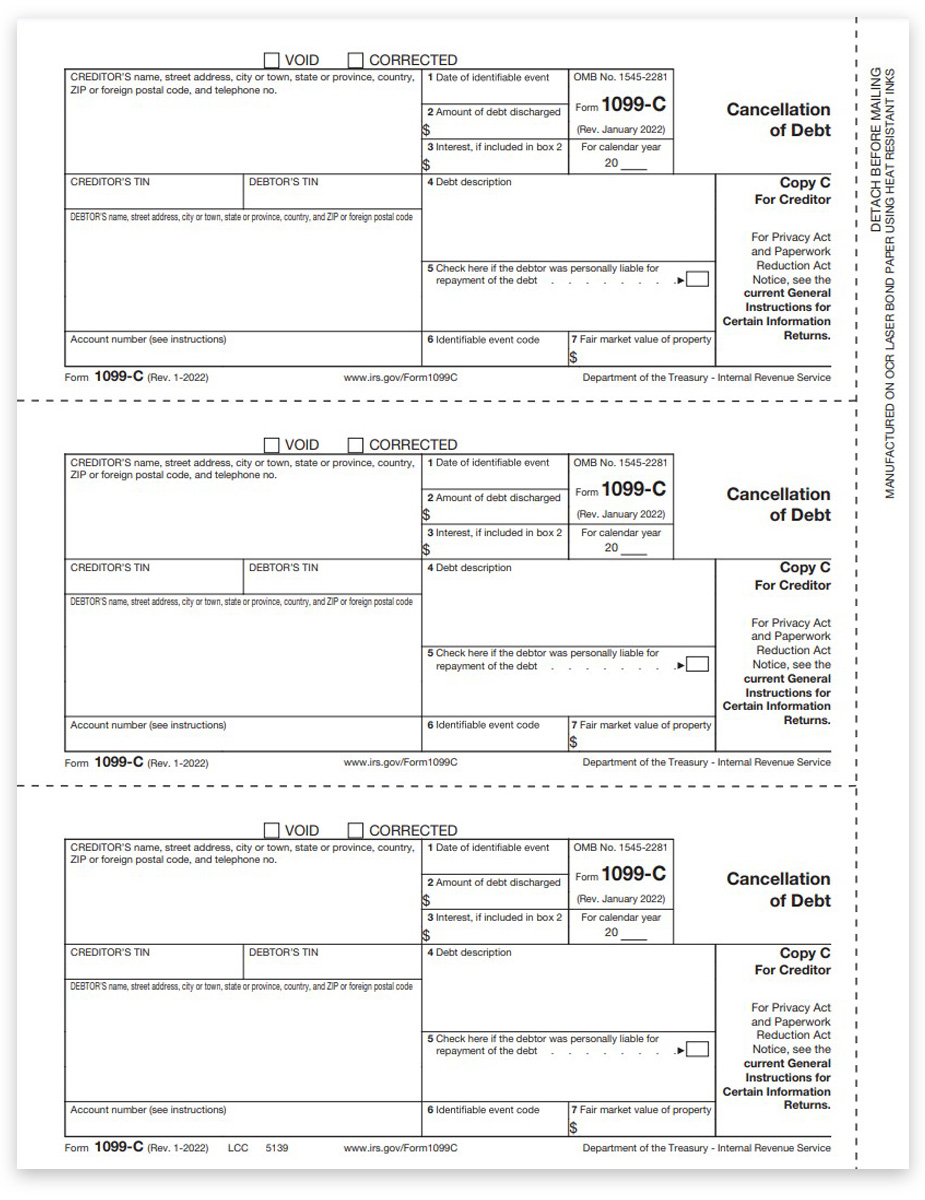

1099 C Amount Of Debt Discharged

1099 C Amount Of Debt Discharged - Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026.

Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026.

Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026.

What does a 1099 C cancellation of debt mean?

Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026.

How To Report Settlement Payments With No 1099

Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026.

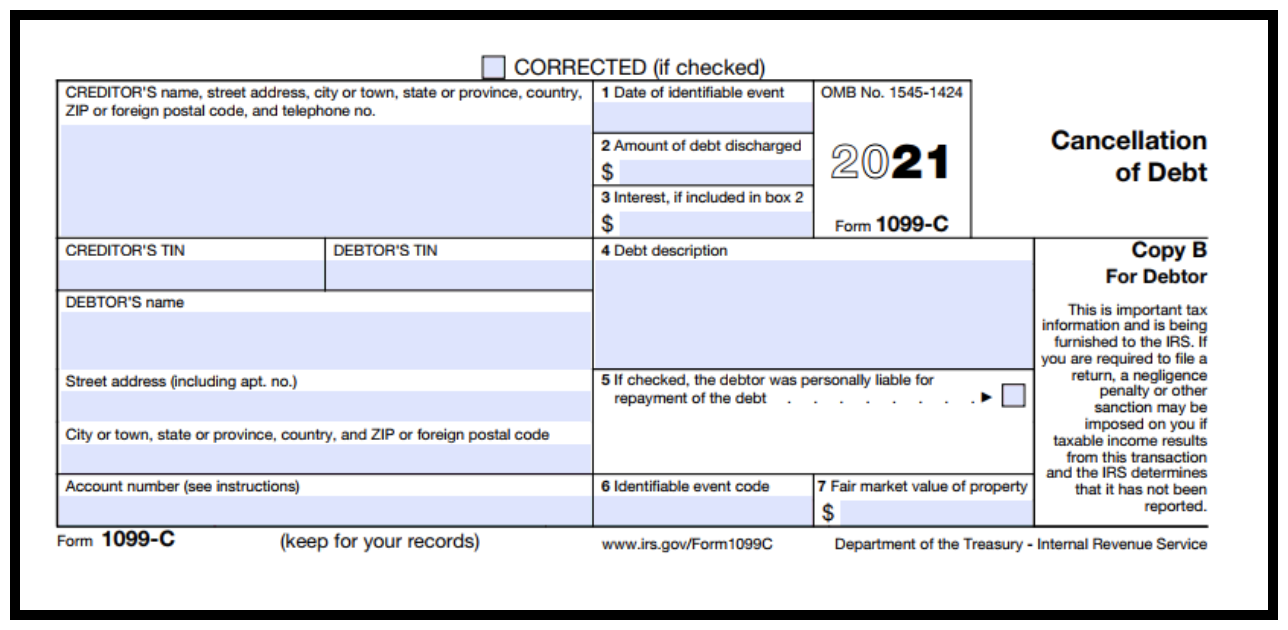

Form 1099C Cancellation of Debt Definition and How to File

Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026.

Should I Be Afraid of the IRS 1099C Cancellation of Debt Form? Tax

Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026.

How can I pay the taxes for the shown on my 1099C?

Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026.

1099C and Debt Harmon & Gorove Newnan Bankruptcy Attorneys

Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026.

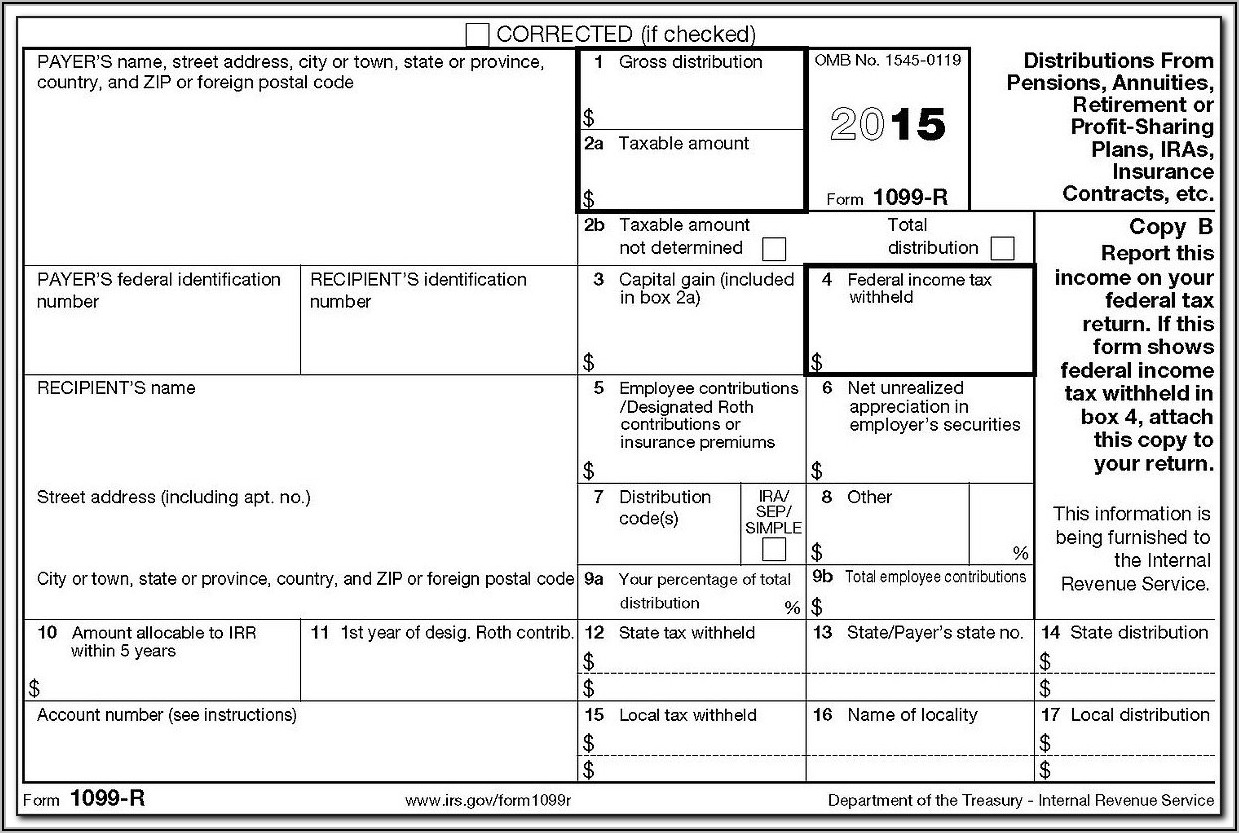

Other Spring 2018, lamc. ppt download

Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026.

IRS Form 1099C Taxes on Discharged Debt SuperMoney

Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026.

1099C The Surprise Tax Form You Get When You Settle Debt

Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026.